Effective June 1, 2024, the state sales tax rate imposed under section 212.031, Florida Statutes (F.S.), on the total rent charged for renting, leasing, letting, or granting a license to use real property (also known as “commercial rentals”) is reduced from 4.5% to 2.0%. Some examples of real property rentals subject to tax under s. 212.031, F.S., include rentals of commercial office or retail space, warehouses, and self-storage units or mini-warehouses.

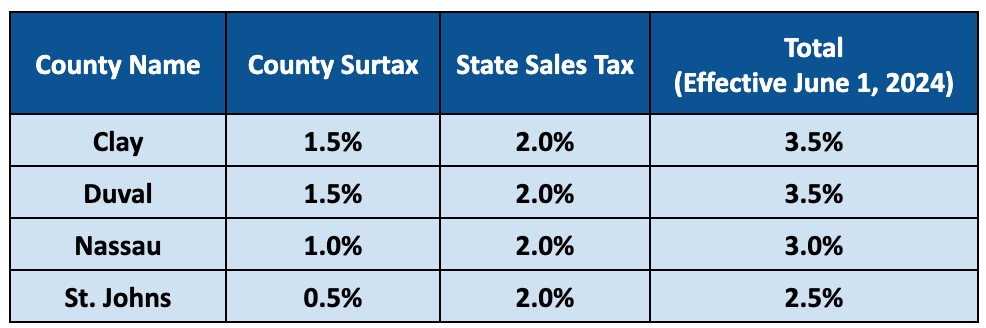

The total rent charged includes all consideration due and payable by the tenant for the privilege or right to use or occupy the real property. The local option discretionary sales surtax imposed by the county where the real property is located continues to apply to the total rent charged.

Sales tax is due at the rate in effect during the time the tenant occupies or is entitled to occupy the real property, regardless of when the rent is paid.

- Rental charges paid on or after June 1, 2024, for rental periods of December 1, 2023, through May 31, 2024, are subject to 4.5% state sales tax plus any applicable discretionary sales surtax.

- Rental payments made prior to June 1, 2024, that entitle the tenant to occupy the real property on or after June 1, 2024, are subject to 2.0% state sales tax plus any applicable discretionary sales surtax.

The reduced state sales tax rate on commercial rentals does not apply to the state sales tax rate on rentals or leases of living, sleeping, or housekeeping accommodations for six months or less (also known as “transient rentals”), parking or storage spaces for motor vehicles in parking lots or garages, docking or storage spaces for boats in boat docks or marinas, or tie-down or storage space for aircraft at airports.