Recent gains appear to be transitory as consumers are expected to pull back on future spending.

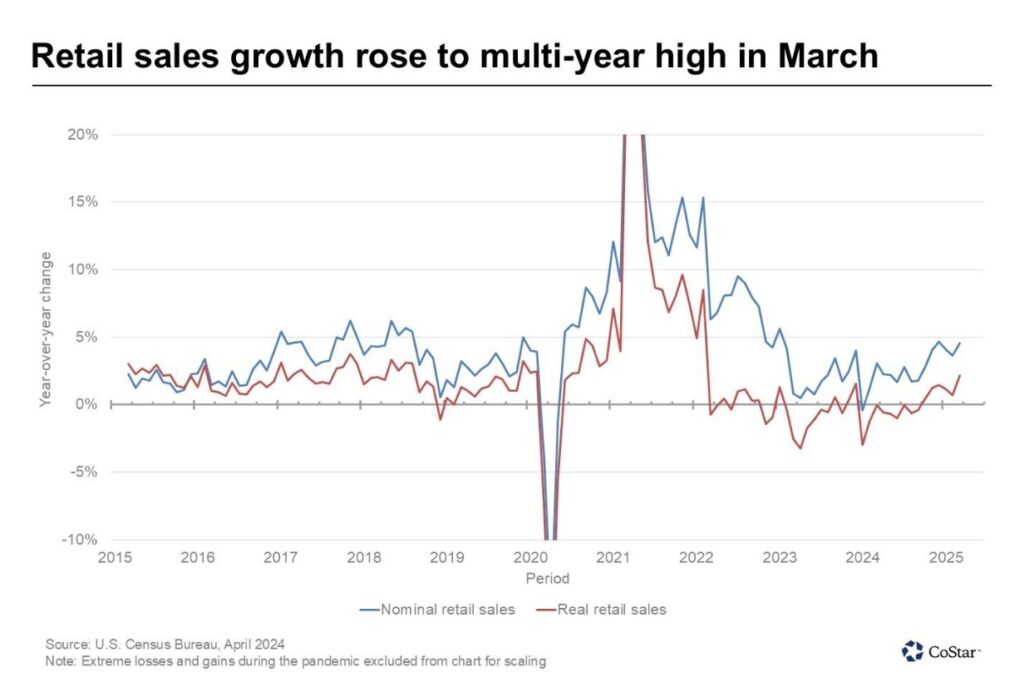

According to U.S. Census Bureau data, retail sales jumped significantly in March, with nominal and inflation-adjusted sales posting their strongest year-over-year gains since 2022. The surge in retail sales, occurring across a broad group of retail categories, contrasts sharply with a weakening broader economic backdrop, including falling consumer confidence, a weakening labor market, and a significant sell-off in equity markets.

While the 1.4% month-over-month gain in headline retail sales was impressive and suggests consumer resilience, the underlying drivers appear to be more temporary tailwinds rather than lasting momentum.

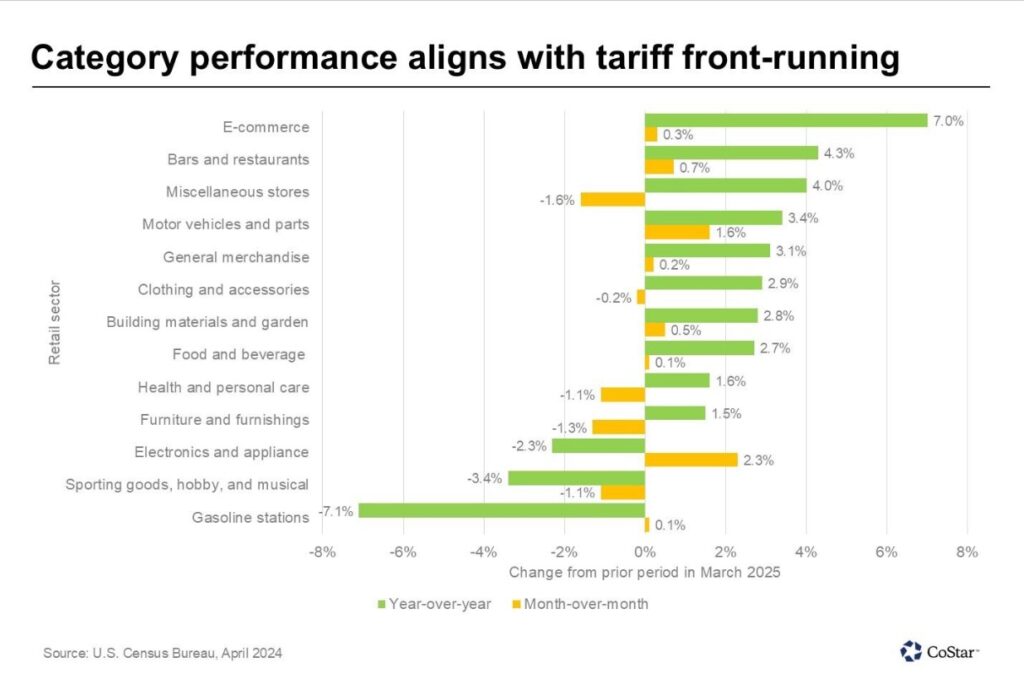

The biggest factor in the March boost likely stemmed from consumers accelerating purchases ahead of the enactment of higher import tariffs. While consumers did not know the exact timing or magnitude of the increases back in March, it was widely reported that significant tariffs were coming and would likely increase pricing on a wide swath of goods. Similar to trends observed in past trade conflicts, consumers appear to be front-loading purchases, aided by additional dollars afforded by tax refunds.

The variance in category performance in March supports this line of thought, as four of the five strongest performing retail categories during the month have significant exposure to higher import tariffs. This includes motor vehicles and parts, which were up 5.3%, building materials and garden, which were up 3.3% (and additionally aided by an early planting season across much of the U.S.), sporting goods, hobby and musical, which were up 2.4%, and electronics and appliances, which rose 0.8% in March.

The increase in electronics and appliances and motor vehicles and parts was especially noteworthy and indicative of households advancing big-ticket purchases ahead of expected price hikes on imported goods.

The one retail sales sector that did not outperform as would have been expected in a tariff front-loading environment was the furniture and furnishings sector, which saw sales drop 0.7% during the month. That said, much of the underperformance in this sector may have resulted from furniture sales reverting to the mean following a couple of consecutive months of elevated sales.

Outside of furniture and furnishings, the only other retail sector to see sales slip in March was gasoline stations. While convenience store sales have generally performed well due to strength in the freshly prepared food category, falling gasoline and diesel prices pushed sales receipts at gas stations down by 2.5% in March and by 4.3% during the past year.

Falling prices at the pump are good for U.S. consumers and retailers, but they will not be enough to offset the higher costs expected elsewhere. As a result, the March numbers are best viewed as a temporary spike rather than a sign of a sustained rebound.

In the most recent April update, Oxford Economics lowered its forecast for retail sales, which are now expected to decline in the third and fourth quarters of 2025, which would be the first two-quarter contraction in retail sales recorded since the height of the COVID-19 pandemic.

This increasingly fragile outlook carries implications for the retail real estate market. While many brick-and-mortar operators benefited from the March uptick, especially those in electronics, home improvement and general merchandise, the potential for sustained sales erosion casts a shadow over leasing and expansion plans for the remainder of the year.

Fortunately, retail space markets should remain tight throughout most of the U.S. as near-historic lows in available retail space and muted construction activity have helped to keep supply and demand balanced in the face of a weaker consumer environment.